Rein in Credit Agencies

Posted

#180

(In Topic #133)

Site director

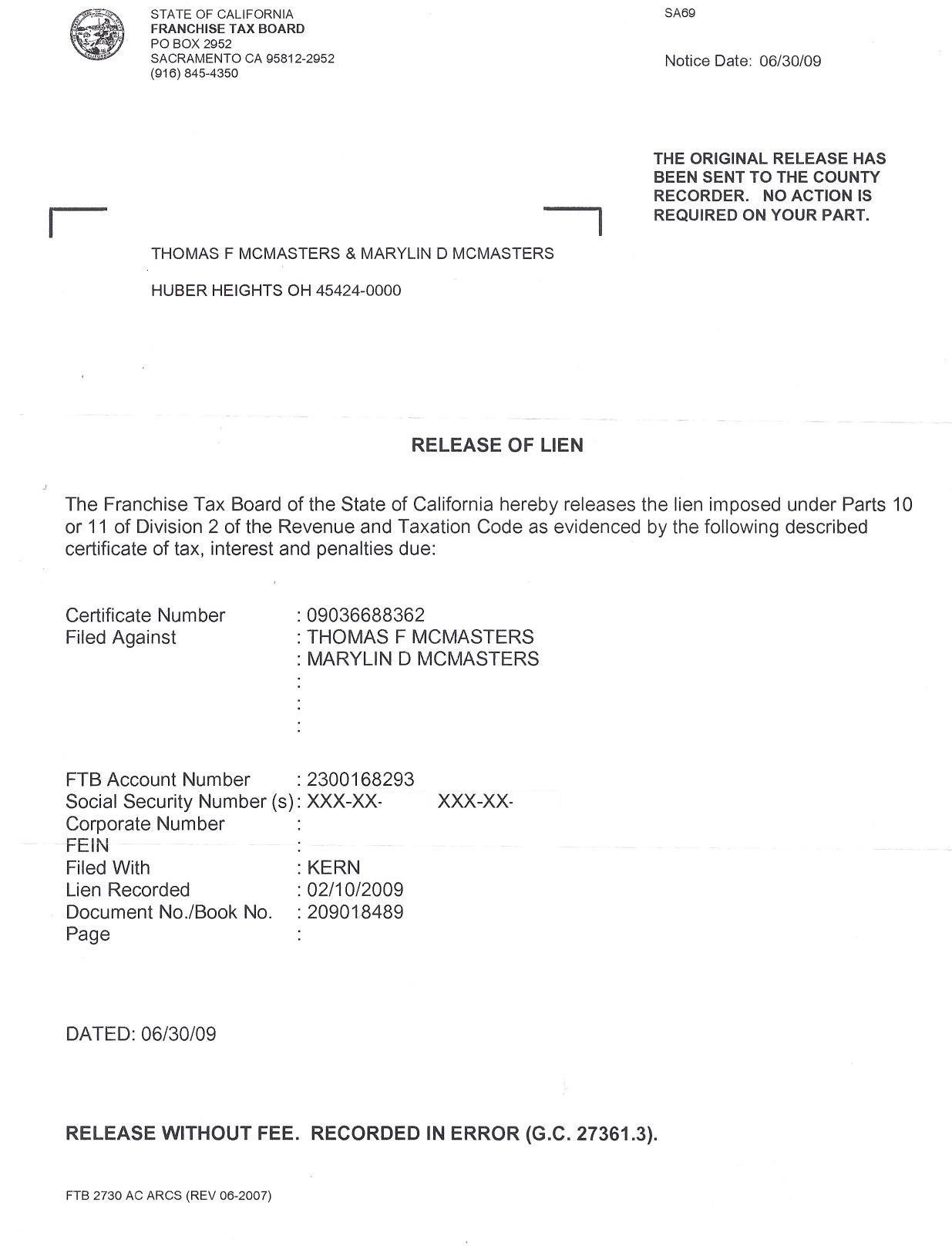

In 2009 I applied to refinance my house and was shocked to find out that California had filed a tax lien against me and my wife and that all three credit reporting agencies were reporting it. After a couple phone calls everything was cleared up with California and they issued the Lien Release you see below that clearly states that it was “Recorded in Error”. California had no reason to file it and said so clearly on the document. Two of the credit agencies removed it from my credit report immediately. Seven years later Equifax is still counting it against my credit score. At the same time I was trying to get Equifax to correct the obvious error, they were trying to sell me their credit alert and protection service which promised to solve issues like the one I was experiencing with them. If an industry isn’t responsible enough to prevent companies like Equifax from trying to extort cash from individuals by making them pay to have them provide correct reports then that industry needs greater government regulations and oversite.

California Lien Release

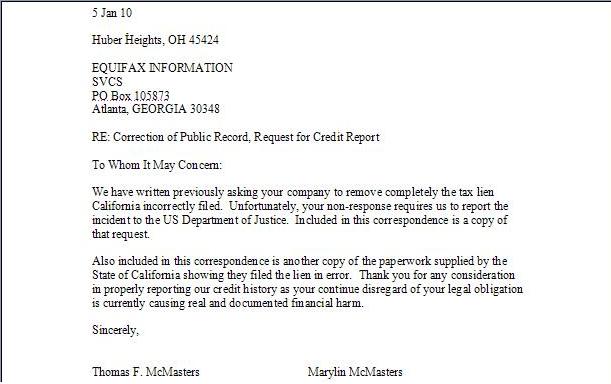

Here is one of many attempts to get Equifax to report correctly

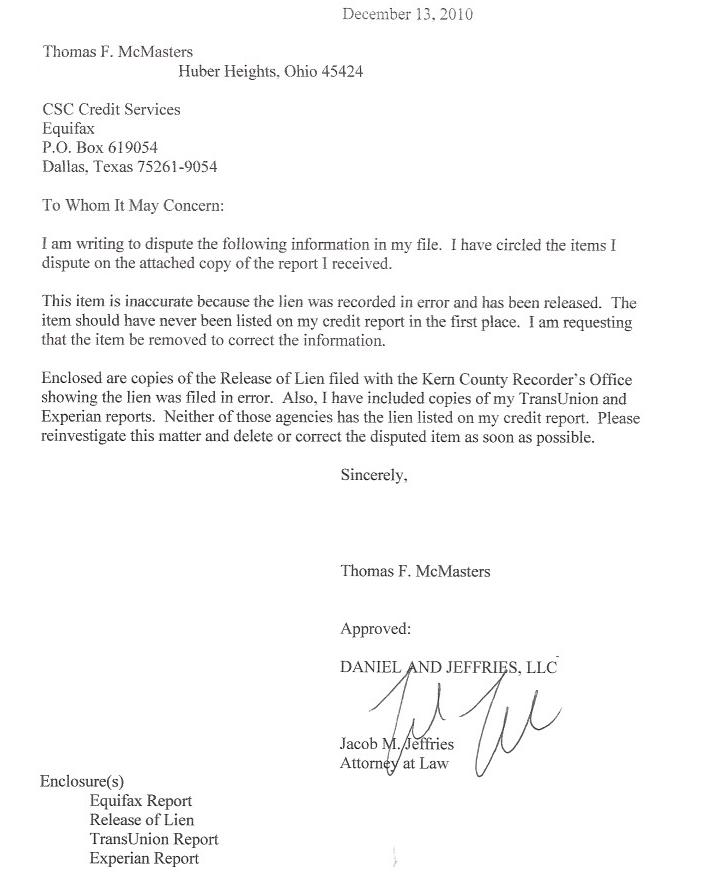

In December 2010 they were still reporting it wrong so we had a lawyer write a letter

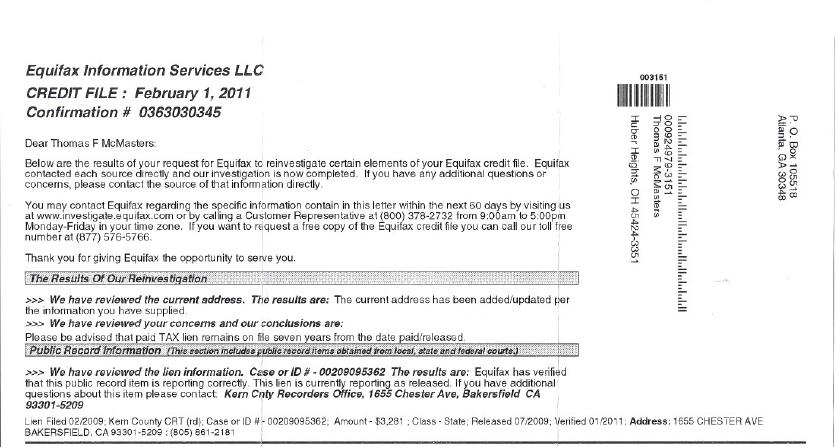

In Feb 2011 Equifax writes telling us they are reporting our credit history correctly

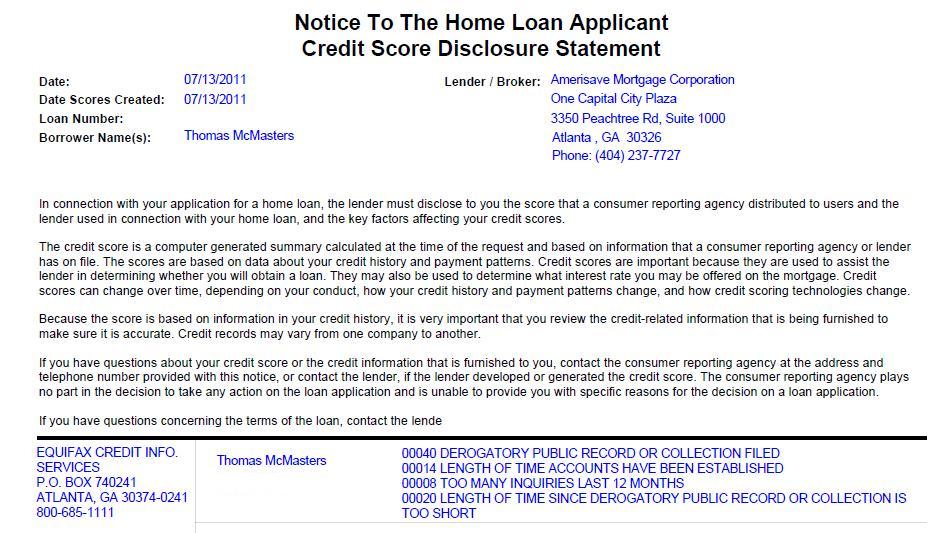

A July 2011 credit report shows Equifax still is reporting incorrect information

Credit scores are important in this society if the industry is unwilling to report correctly on their own, I will be more than happy to make sure laws are in place to make sure they do it because they have too.

Last edit: by Tom_McMasters

Last edit: by Tom_McMasters

1 guest and 0 members have just viewed this.

Control functions: