Stop - taking 70% of the School's property tax to pay for the City's recreation debt.

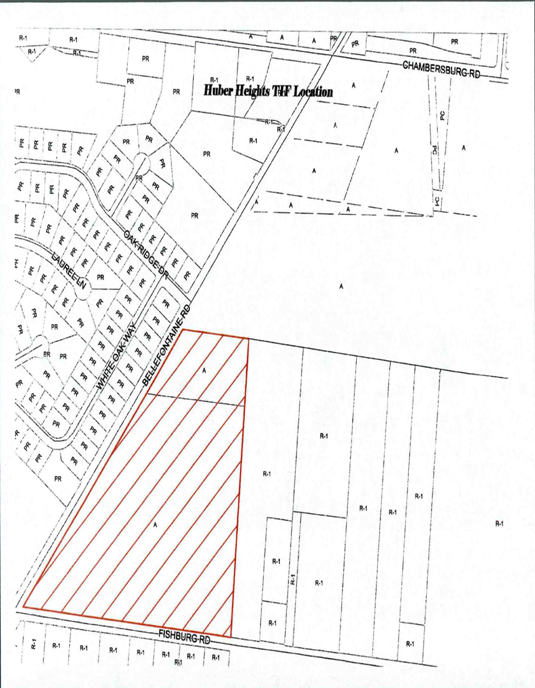

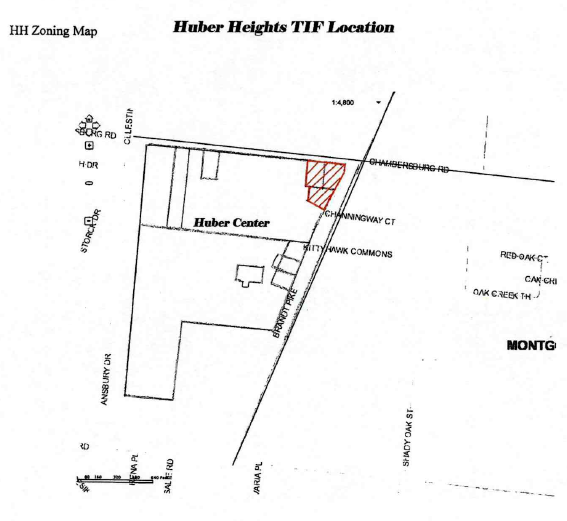

Let me forcefully state that this headline accurately reflects the issue when the discussion is about the Alcore assisted living center that just went up at Fishburg and Bellefontaine and the new Family Dollar being built at the Huber Center. I have no reservation in saying that the your city council underhandedly siphoned off 70% of the property tax that rightly belongs to the schools. If the assessed tax value of these properties matched the construction costs this means the city essentially stole $227,000 a year from the schools on just these two properties.

|

|

If I could just keep myself from going any further – I would be a real politician! But my objective is responsible government and in order to get responsible government we need for those people capable of understanding the issues to have an intellectual discussion (if you read this and don't understand how TIF works blame it on my writing - then lets discuss and improve this explanation).

Let me say two things before I show you why I am absolutely sure the schools deserve the other 70% of the taxes they would normally get from the Alcore and Family Dollar properties. First caveat, I doubt very much the assessed value of these two properties will be the same as the construction costs. Second, there are many more TIF properties in Huber Heights than just these two properties. Even though the city takes about 70% of the property tax that would normally go to the schools for those properties I would not classify that arrangement as underhanded.

My son and I created an Excel worksheet that shows the full Montgomery county tax levy distribution for Huber Heights - download

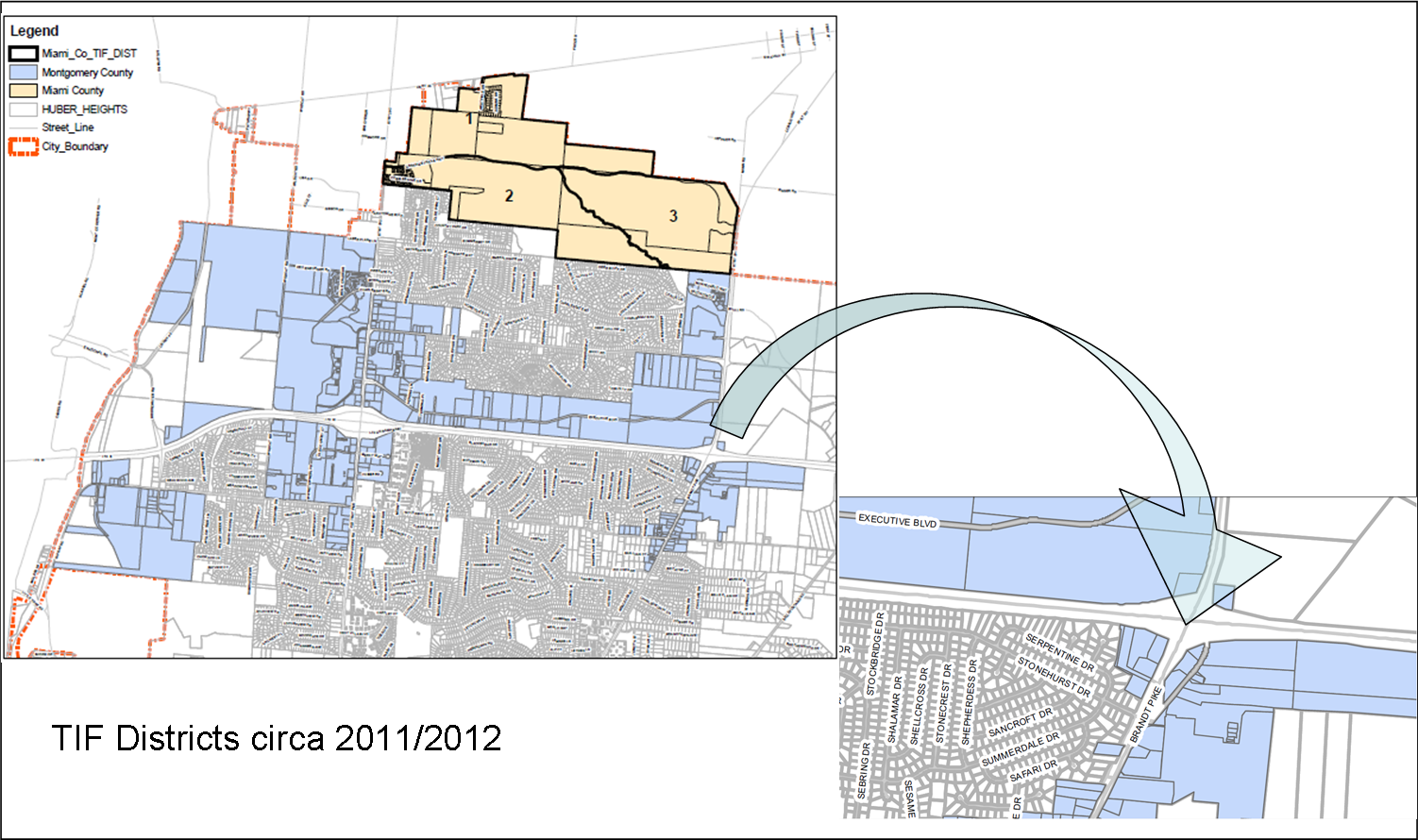

Now the meat! First off, what is TIF. TIF is an acronym for Tax Increment Financing. Simply put TIF is a modification of the property taxes designed to help cities build infrastructure like roads and sewers. It works by allowing the city to divert most of the property taxes away from where they would normally go, like county parks, libraries, schools, police and fire funds etc., into a "special assessment" (aka TIF fund) that is controlled by city council but only used for infrastructure.

It gets complicated when we try and tell you what "most of the property tax" means. I'll skip talking about the little amount that stays exactly the same as it always was, except to say that there is a little amount that is not affected by TIF.

When talking about the property taxes that are affected by TIF it gets complicated because the city can't take them all but they can take more of them if they "negotiate" with the schools.

In a nutshell, the city can take 75% of the property tax without negotiating. The other 25% would then go to all the normal places; county parks, libraries, schools, police and fire funds etc. exactly they way the would without the TIF. In this situation where the city goes out on its own and declares a piece of property TIF the schools would get 25% of normal. However, if the city negotiates with the schools then together they can cut out all the other places property taxes normally go (county parks, libraries, police and fire etc) and divvy up 100% of the property tax between themselves. When the City and School systems sat down and negotiated how they were going to divvy up everyone else's portion (County parks, libraries, police and fire etc) , the agreement they came up with is the schools would get 30% of what they normally would get and the city would get the rest.

|

|

| A piece of property is assessed a property tax | The property tax is distributed according to voter levies (and inside millage). |

|

|

| If the city talks the property owner into it then the city can pass a resolution and take 75% of the property tax. The rest is distributed to all the other organizations according to the voter levies (and inside millage). The schools, police, parks, libraries etc can't stop this (unless they can get the public to tell council they don't like it). | If the schools join with the city then the city can pass a resolution that takes all the property tax away from all the organizations except the school. The school gets the negotiated amount. For the Huber Center and Alcore TIF properties the school gets 30% of what they normally would get. |

That was easy enough to understand, right? Ok so now I'm going to point you to some reference so you can look it up and see that I am right. But before I do that let me talk about a couple more complicating items. When I point you to the agreement you will see that it covers two time periods. Those time periods are the first ten years and then the next twenty years. Guess what, everything I said above is correct for the first ten years. From year eleven through thirty the agreement is different and in fact the school will get 100% of what they normally would in these years. There is a perfectly logical explanation for this and when you read and understand the law you will know why. So the law is the second reference I give. Let me give you a heads up - it lets you know why the above arrangement is logical and it does it in legal language - good luck.

So here is the link to the City School Agreement for Alcore and here is the one for Family Dollar.

Here is the link to ORC 5709.40

In a minute I will actually get down and dirty and show you the numbers. Before that though let me state that 30% of what they would normally get is not fair to the schools for these two properties. Here is why.

In a lot of situations a business can't build someplace because there isn't good enough infrastructure. TIF gives the city a way to solve this problem. The I-70 interchanges is a good example. Would Meijer have moved from Woodman up to Executive Blvd if there wasn't an exit from I-70 to Brandt Pike? Probably not. So cases like Meijer complicate whether taking 70% from the schools is good or bad. However, both Alcore and Family Dollar committed to building and paying for their facilities. It was the city that pushed for these properties to become TIF properties because the city needs money to pay for the Music Center. Both of these companies were prepared to pay normal taxes at normal rates to the normal places. Conclusion; these business were about to pay the schools 100% of the normal taxes and then the city swept in and took 70% just because they could.

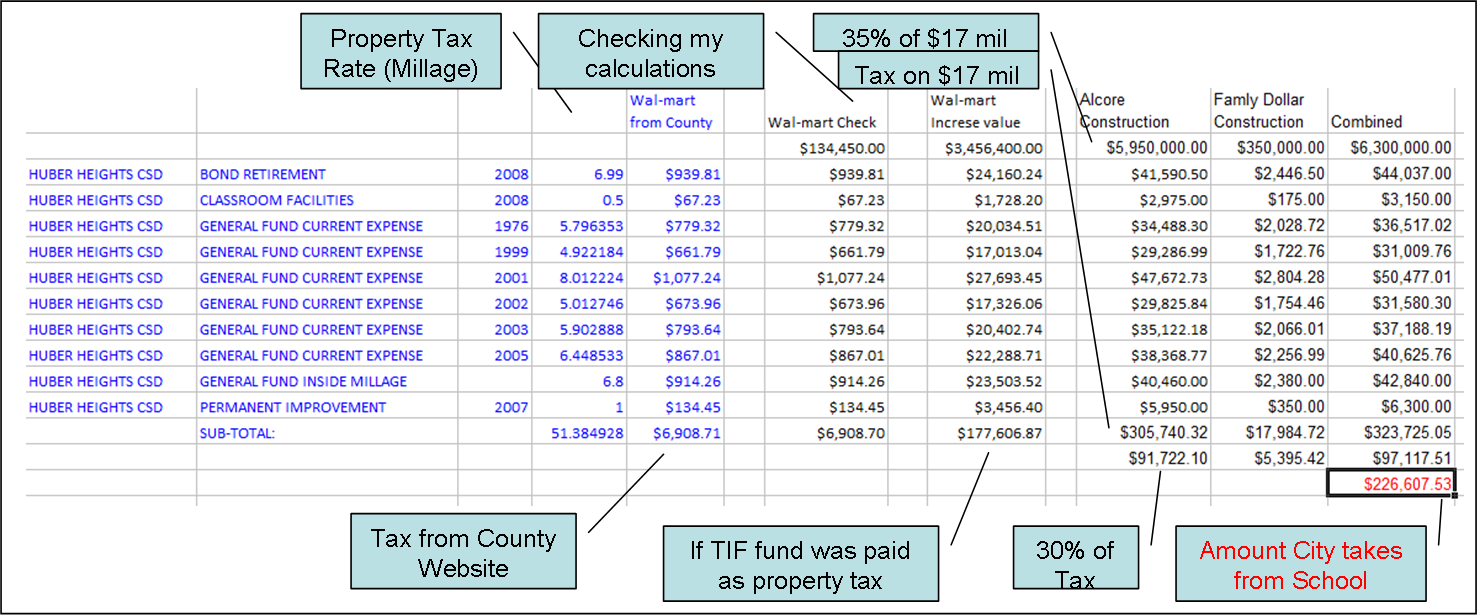

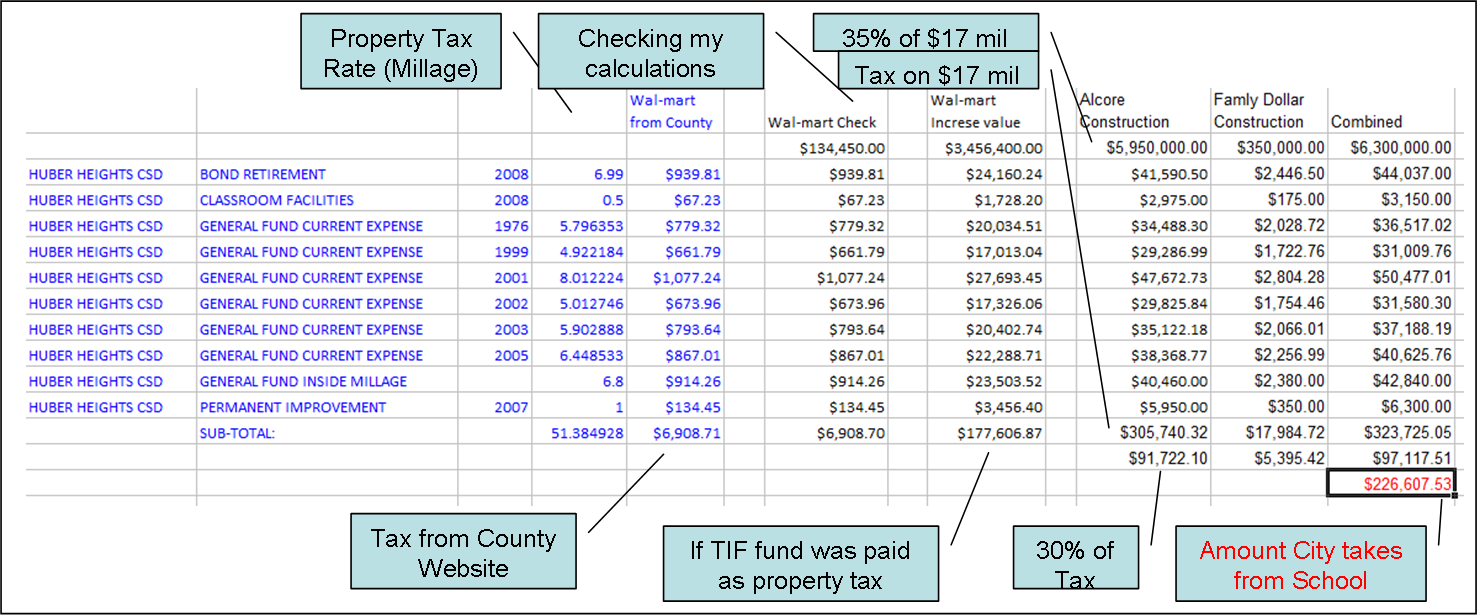

The Numbers. (Note: The MS Excel worksheet has been updated, since I originally wrote this article comments from the assistant city manager indicate the appraised value of the Alcore property will be about $14 million. So the revised number for how much of the Alcore payment the city is taking from the schools is $177,000 a year).

Lets get an idea of the amount of money the city has chosen to take from the schools. Below is a chart of my calculations. In that chart I assumed that the final property would be given a tax value (assessment) that was close to how much it cost to build the buildings. For the Alcore building the city help arrange $17 million dollars of financing. I'm using an educated guess that the Family Dollar building will be about $1 million. So the combined tax value of the two buildings will be $18 million. I'm pretty sure that when the county actually does the assessment they will pick a number less than $18 million dollars. So this initial calculation is probably high. The actual assessment is probably somewhere between $ 9 million and $18 million. If it turns out to be $9 million than the calculated number should be cut in half of what this shows.

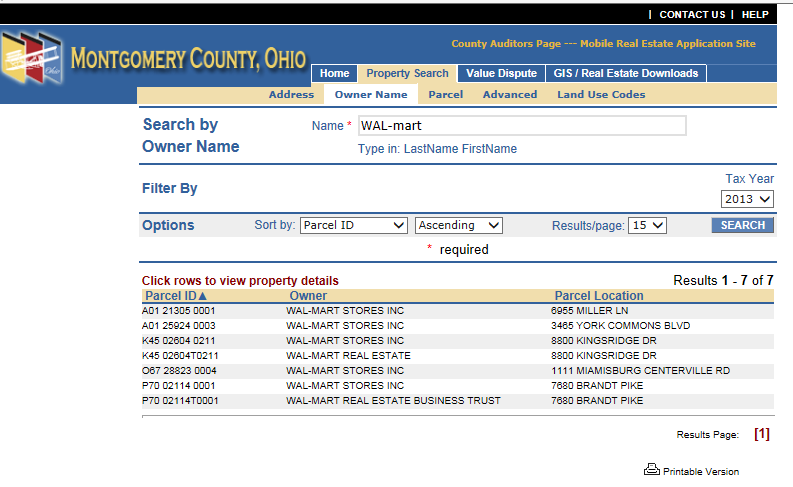

Lets look at where I got the information for the columns. First I went to the Montgomery County Website and found the Auditors page and then Property Tax search by owner name. I looked up Wal-mart because I know Wal-mart is already in the TIF district.

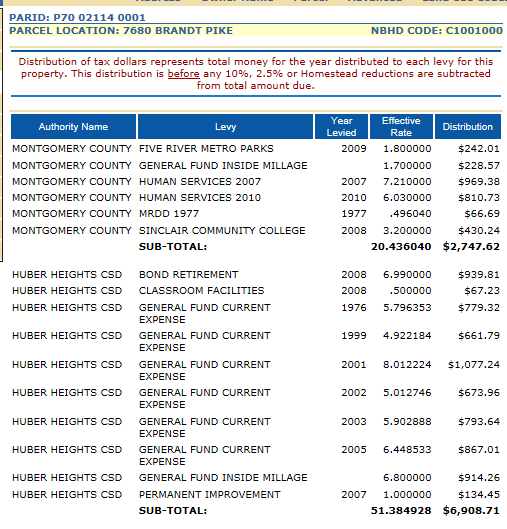

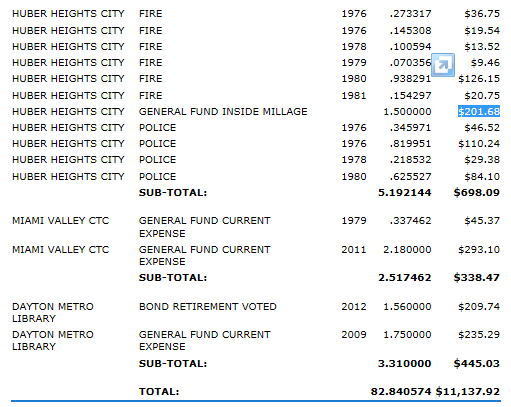

Looking at thefirst entry on Brandt Pike you can click on Levy Distribution and get a break-out of all the property taxes; what organization they go to, millage and how much total. I couldn't take a screen shot of the entire list at once so here is the list in two pieces.

|

|

The first thing I notice is that my Tax to TIF cartoon above doesn't do a good job of showing the real distribution of property taxes. My cartoon has the school getting 4 of 10 dollars. Looking at this the school actually gets 7 out of 11 ($6908.71 out of $11,137.92). I have to stop hear tonight. I can't believe what our city council has done to our schools. Until this very minute I was ok with the larger TIF district that is concentrated up near the interstates. Right now I am annoyed as anything that last year while the schools were dying council didn't save them by returning the TIF money they collect from Wal-mart, Meijer, Gander Mountain etc to the schools instead of building the Aquatic Center. The idea that they plan to force even more properties like the new Family Dollar and the Alcore Center into the TIF and suck even more money away from the schools while putting the city at financial risk with the Music Center makes me fighting mad.

This page is under construction.

Still to come - Finish the explanation of the calculations shown above. Then a YouTube video of me talking this through. Oh yea, and I'll probably have to re-write a couple sentences for clarity. I Appreciate your help on that.

Save the Schools Flier - TIF properties divert property tax money away from the schools. Used correctly they are a great asset. Used the way we do it in Huber they are dangerous to the City and the Schools. .pdf download